What is credit insurance?

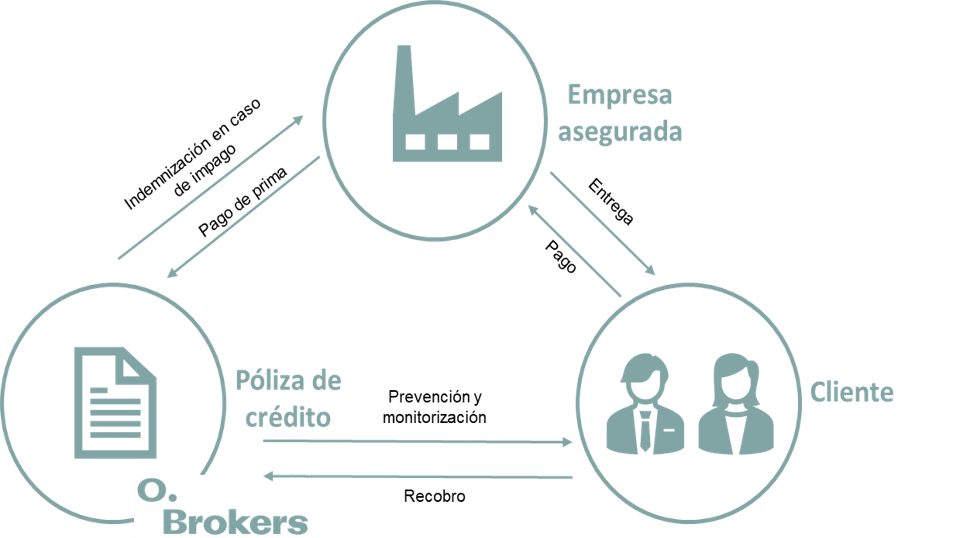

Credit insurance is activated when there is a default in credit transactions between companies.

How does credit insurance work?

Credit insurance supports commercial teams in three phases:

- Providing information about the client before accessing to it

- Indemnifying in case of non-payment

- Managing the recovery of the amount unpaid

It also offers new customer prospecting tools that make it easier for sales teams to seek out new customers.

How do we work credit insurances?

Before we start working on a credit policy proposal, we ask about the client’s business strategy and their concerns and we analyse the client’s portfolio and default history. Based on all this information, we study which type would be the most appropriate.

We work on each proposal with a minimum of three different insurance companies to see which one best suits their needs in terms of premium and coverage.

We present the proposal by estimating the cost of the credit insurance both for the first year and for the following years. For this purpose, we consider the premium and the costs of portfolio acquisition, classification and maintenance.

- Traditional fixed-rate or variable-rate credit insurance

We can offer credit insurance with either a fixed rate or variable rate, depending on the insured party’s preferences.

- Credit insurance for a selected group of clients

The entire client portfolio can be insured or only a specific group of clients. This type allows the company to select the customers whose risk of non-payment it wishes to transfer.

- Excess losses

Excess losses can also be insured to cover extraordinary losses caused by customer non-payment. An annual deductible is established, and the policy is triggered when losses exceed that deductible.

- Single Project/client

This type covers a single client, transaction or project. It is a good solution for companies that have a portfolio of customers with a low risk of non-payment, but wish to cover a customer or special project, either because of its economic situation, its weight in the turnover or the volume of the transaction. This solution also covers the manufacturing risk for engineering projects and customised equipment.

What is a surety policy?

The purpose of a surety policy is to provide security for the performance of a contract. The performance of the policyholder towards the insured is insured. In the event that the policyholder breaches a contract, it is the insurance company that indemnifies the insured. The payment made by the insurance company will be reimbursed by the policyholder of the surety policy.

team